A White Swan is Coming for your Nest Eggs

The next financial crisis is looming. Are you ready?

Our crack-riddled economy is still recovering from addiction , with the effects of detox still expected to cause pain. After an unprecedented stretch of 15 years of free money and debt accumulation, we’ve entered a new period of higher interest rates. What many may not be considering is how much low interest rates create perverse incentives for both personal and business finances, especially in regards to risk. We are in for a reckoning.

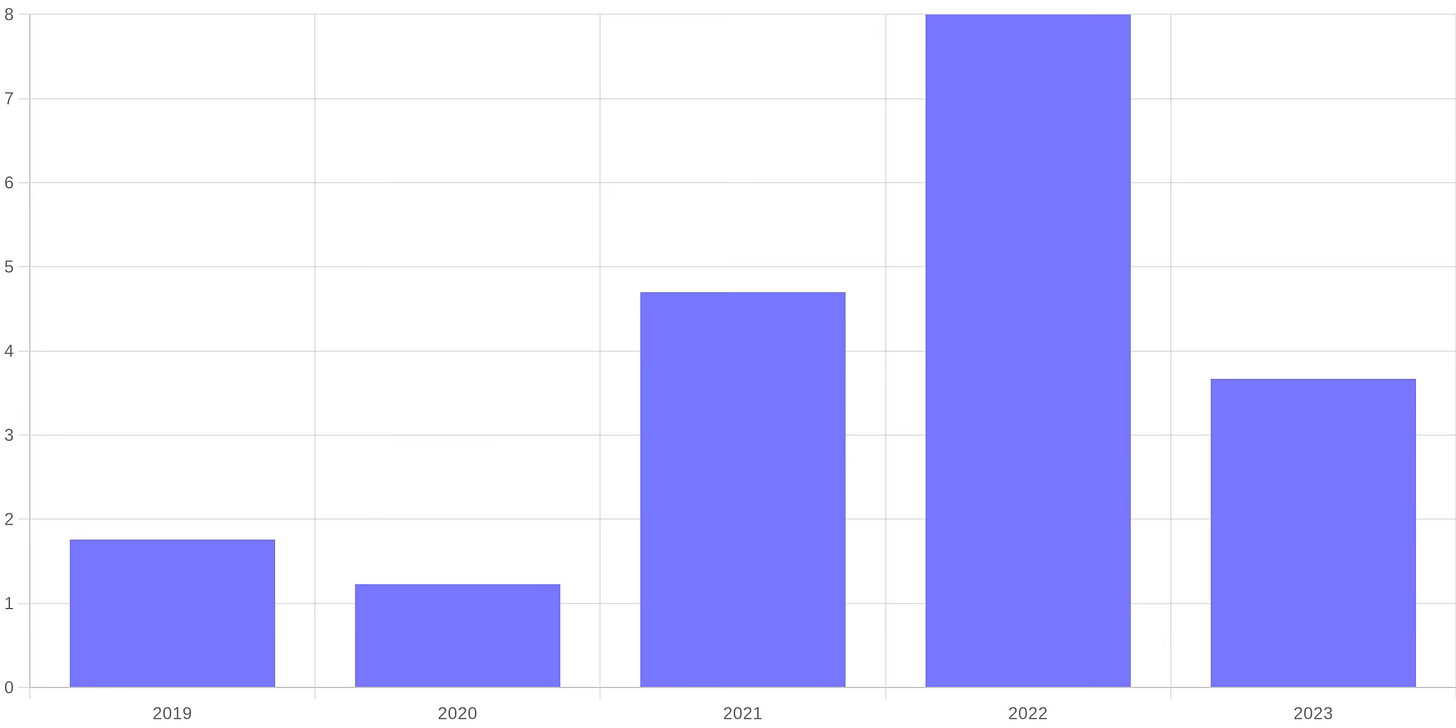

Since the COVID pandemic erased a humming economy, and spending in Washington accelerated to close the gap, inflation has reared its ugly head for the first time since the seventies. It has been very high (historically) since it began to rise in January of 2021 and remains 85% higher than its historic average (and Federal Reserve target) of 2%, coming in at 3.7% in this morning’s report.

According to the website in2013dollars, inflation has increased 19% since 2020 - an amazingly high number historically. This means that the dollar you had in your hand in 2020 is now worth $0.84. And if your monthly expenses were $5,000 in 2020, they are now almost $1,000 more, at $5,950.

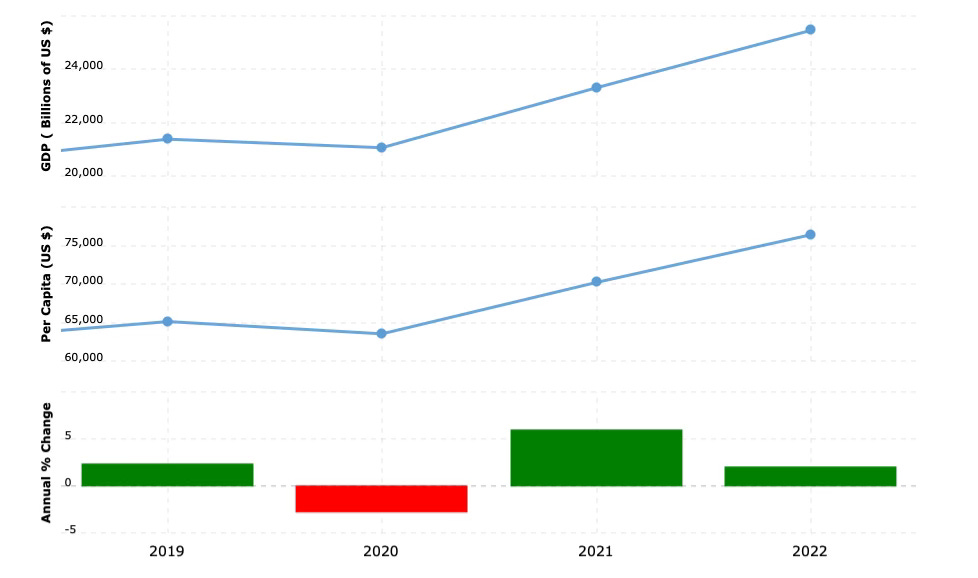

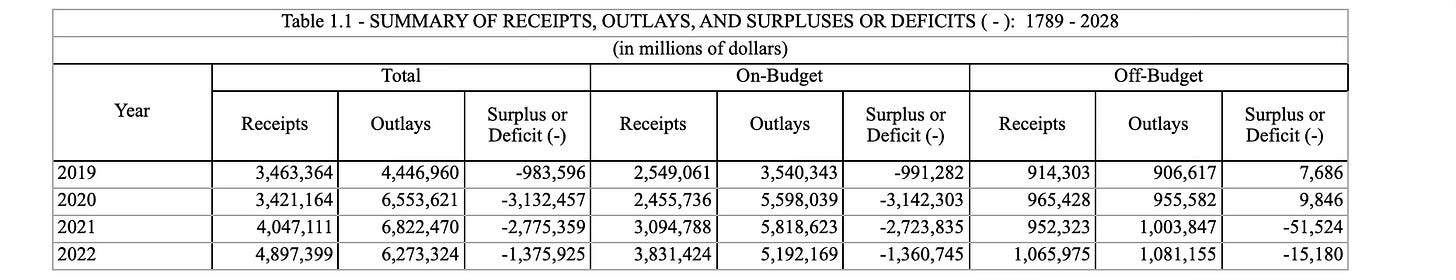

Even worse, although the economy is growing, a significant portion of the growth is government deficit spending, which is an unsustainable model for economic prosperity. According to Macrotrends, the national Gross Domestic Product has risen from $21.4T in 2019 to $25.5T in 2022, a healthy growth of $4.1T in new economic activity. But over approximately the same period (because the Federal Government works on an October fiscal year and GDP data uses the calendar year) US Federal Government outlays increased from $4.4T in 2019 to $6.3T in 2022 - a $1.9T increase according to data downloaded from the OMB at the White House.

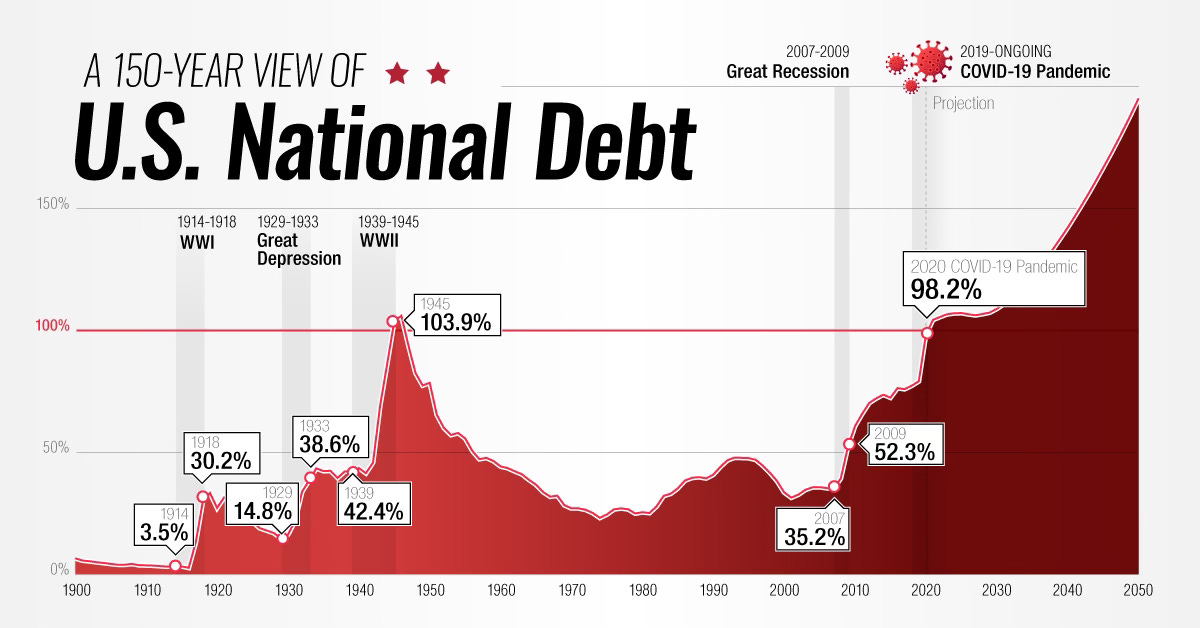

This means that approximately 45% ($1.9T of $4.1T) of the GDP growth over this period was simply government deficit spending - which will serve to increase the debt, increase the amount the federal government has to pay on the interest of that debt, and will cause more inflation as the Treasury and the Fed are forced to print new money to enable this profligate spending process. We wrote about the incestuous and appalling details of deficit spending and inflationary moves by government here. It is very much not good for the people.

But besides inflation, deficit spending and debt service (which will become so much more costly as interest rates have risen and stay high) the biggest indicator of a looming recession is the state of real estate prices and debt in America. Nassim Taleb, who is famous for predicting the 2007-08 financial crisis and author of “The Black Swan” predicts that real estate, startup funding and the stock market drive will the next crisis, and the impacts may be as big as the 2007 crisis. See here:

His main concerns center on two real issues - first that real estate prices have not dropped in any meaningful, despite the cost of a mortgage and other financing options for commercial real estate costs doubling in costs. As he says, mortgage rates have increased from 3% to 7% - prices should have fallen significantly at this point but they haven’t.

What he doesn’t mention in that interview is the reason behind this - banks. Many banks hold loans and other financing instruments for these real estate properties that would be insolvent were the properties marked to an appropriate price. We’ve probably forgotten already but the recent troubles at Silicon Valley Bank and others have not been solved. Wall Street has been warning since then that there will be a correction and as Talib says, “this system needs to tumble…systems do not correct themselves without pain. No one can predict when this crisis will start, but it is clear to many, including the New York Times, that a reckoning is coming - it is just a matter of when.

For the average investor, things are changing quickly and it can be confusing. We have not had such high interest rates in such a long time, I am sure many have forgotten what to do in this environment. While I am no financial expert, I highly recommend you consider talking to your financial advisor about these changes, and as Talib recommends get out of technology plays (likely to be overvalued by the free money private equity boom), real estate and potentially even the stock market. With things like Treasuries, CDs and other long term low risk plays now paying yields of 5% or more, consider weathering the coming storm like your parents and your grandparents used to do. It is time to de-risk your nest egg before the fall.