The "Booming" Economy

Slowing GDP growth, rising inflation, housing unavailable and unaffordable, employment still below pre-pandemic levels. What exactly is booming?

In August, Newsweek declared, “Biden’s economy is booming, here’s why you’re not feeling it.” In November, The Washington Post complained, “Biden’s economy is booming, but voters are unhappy,” and Salon fawned, “Biden’s economy is honestly pretty amazing: How come he doesn’t get credit?” Just ten days ago, Bloomberg proclaimed, “Biden’s Hot Economy Stokes Currency Fears for the Rest of World.”

But after months of hearing the Biden Administration and their fans in the media proclaim a booming economy, the jig is up.

GDP

After a hot quarter in Q3 last year of 4.9% growth, growth has slowed to less that one third of that figure in the latest GDP report to 1.6% - missing even lackluster expectations of a 2.5% consensus. This lines up with the trend as Q4 had slowed to 3.4%. If that trend continues, we will be in recession later this year.

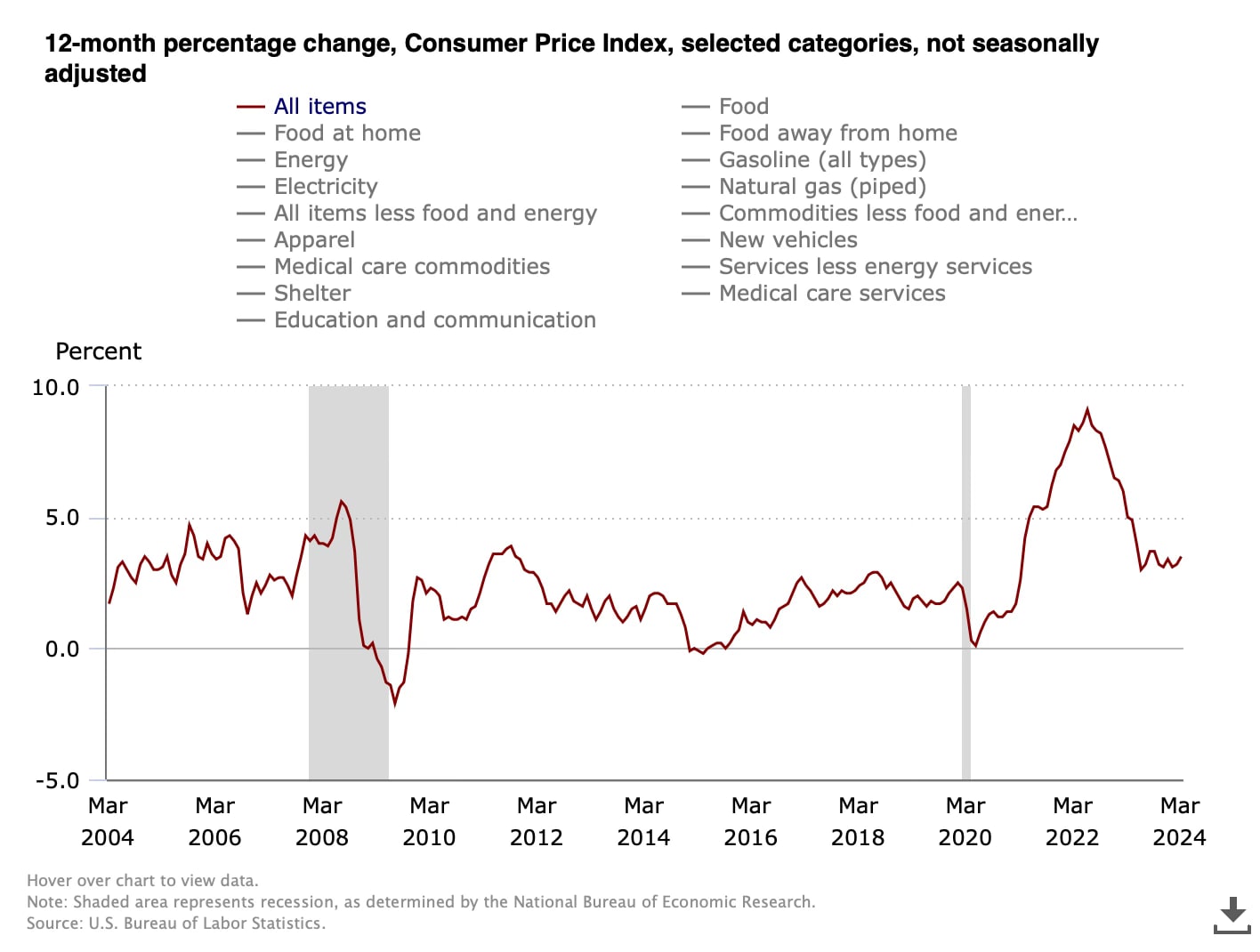

Inflation

Inflation is rising again as the economy has not and perhaps can not absorb the huge growth of the money supply due to the continued trillion dollar deficits produced by Congress and the White House. After the peak of 9.1% in June of 2022, and a subsequent fall to 3.0% a year later in June 2023, inflation is rising again with the latest figure at 3.5% - still 150% higher than the Fed target of 2.0%. Inflation was 1.4% when Joe Biden took office and it has never been at or below the 2.0% mark since February 2021. This sustained level of inflation and high prices is creating major shifts for the worse.

Real Estate

Shelter costs have had a huge spike for maximal negative impact on most Americans. Redfin reports buying a home costs more than ever. 78% of aspiring homeowners say they can’t afford the current prices. Half of renters report they can not afford their rent. Auto and homeowners’ insurance costs are skyrocketing. In many areas, there are not enough homes available even if they were affordable. Residential real estate is generally high priced, not readily available, more difficult to buy and maintain than ever and loans are relatively expensive due to the current high interest rate environment.

On the commercial side, especially in office space, the problem is precisely the opposite. Since COVID, the rules of onsite work have changed and it does not appear the pre-pandemic office needs are coming back. When coupled with the credit crunch caused by the lack of demand and changes in interest rates, banks are frantically trying to dump commercial real estate debt that is upside down on the balance sheet. Fortune reported back in October that $80B in commercial real estate debt is in distress, and it’s likely much worse now. Commercial real estate foreclosures jumped 117% in March according to Fox Business, and many believe the coming collapse of this market will spell trouble for the broader economy as banks may fail or need bailouts to cover their bad real estate loans.

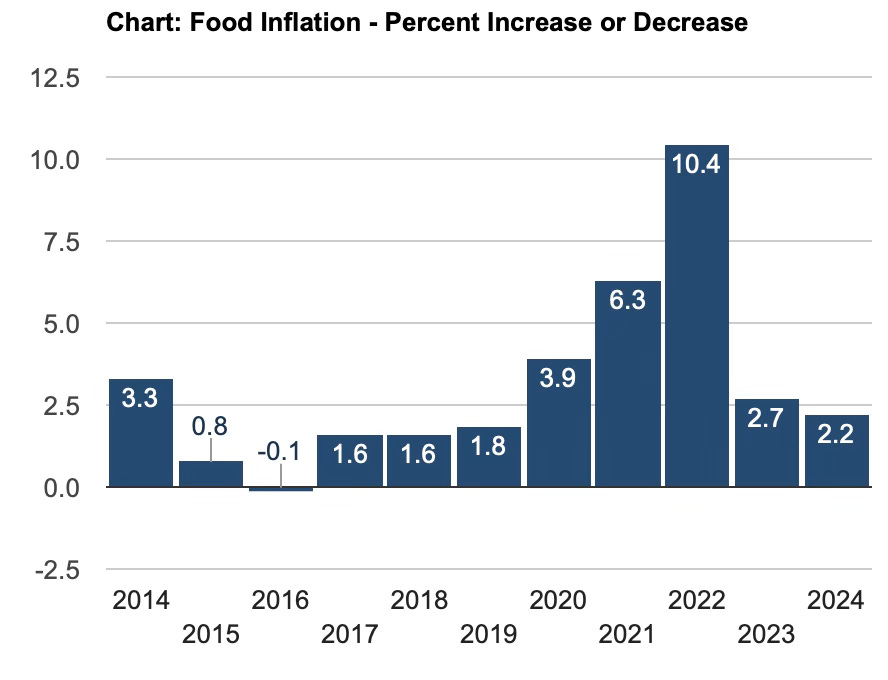

Food

Food costs are ridiculously high. This has been reported so many times in so many places, I don’t think any one needs to be convinced. Food costs rose in 2022 faster than any time since the stagflation of the 1970s and they remain high as prices continue to rise, albeit at a slower rate. Wages have not caught up causing more trouble on the family checkbook.

Employment

While employment reports generally have been positive, the numbers are not to be trusted. They have significant error rates, and the BLS’ method of describing unemployment leaves a lot to be desired - a large chunk of the new jobs counted in the past year have been part time jobs and mostly filled by foreign-born workers. Native-born workers’ jobs have not recovered since the recession and the gig economy is squeezing people’s ability to earn a living. An important measure of employment - the US Labor participation rate - has not recovered from COVID:

If these trends continue, there will be a recession this year that may trap the Fed. What will they do when GDP goes negative and inflation is still high and rising?

If Congress and the White House do not get serious about cutting spending and the money supply soon, we may all be in for a difficult decade.